south dakota property taxes by county

Motor vehicle collections are divided between the county cities townships and the state of South Dakota. Second half are due by October 31 st.

Loudoun County Va Property Tax Calculator Smartasset

Learn About Owners Year Built More.

. A South Dakota Property Records Search locates real estate documents related to property in SD. Property assessments are public information. Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year.

See Property Records Deeds Owner Info Much More. Taxes that accrue in 2008 are due payable in 2009 Tax notices are mailed by mid-February. For more details about the property tax rates in any of South Dakotas counties choose the county from the interactive map or the list below.

You can also send forms to. This value is reflected to the market value in which most people would likely pay for a given property in its present condition. Find Details on South Dakota Properties Fast.

First half property taxes are due by April 30 th. This site is designed to provide you with additional methods to research your property information and to allow you to pay your property taxes online. Ad Get In-Depth Property Tax Data In Minutes.

The countys average effective property tax rate is 141. Of course these counties have the highest number of residents but how are property taxes calculated in South Dakota. If you own property in Lincoln County then you pay the highest amount at 2470.

Property owners may review the information that the county office has on. Property Taxation Records. Convenience fees 235 and will appear on your credit card statement as a separate charge.

Lincoln County collects the highest property tax in South Dakota levying an average of 247000 146 of median home value yearly in property taxes while Mellette County has the lowest property tax in the state collecting an average tax of 51000 102 of. The typical homeowner here pays 2535 in property taxes each year. Custer County collected more than 10 million in real estates taxes in 2008.

To 5 pm Monday - Friday. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. Tax amount varies by county.

Search Any Address 2. Ad Look Up Any Address in South Dakota for a Records Report. Motor vehicle fees and wheel taxes are also collected at the County Treasurers office.

Then the property is equalized to 85 for property tax purposes. Any person may review the property assessment of any property in South Dakota. Get In-Depth Property Reports Info You May Not Find On Other Sites.

South Dakota is ranked number twenty seven out of the fifty states in order of the average amount of property taxes. Real Estate taxes are paid one year in arrears. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County.

SDCL 10-24-1 Person can redeem property sold at sale at any time before tax deed is issued amount to. The Department of Revenue has all the answers here. See Results in Minutes.

The county treasurer also collects property taxes for the county city school districts and any other political district authorized to levy real estate taxes. South Dakota law requires the equalization office to appraise property at its full and true value as of November 1 of each year. To view all county data on one page see South Dakota property tax by county.

Elderly and disabled South Dakotans have until April 1 2022 to apply for property tax relief under South Dakotas Assessment Freeze for the Elderly and Disabled Program. Under the program a qualifying homeowners property assessment is prevented from increasing for tax purposes. A home with a full and true value of 230000 has a taxable value 230000 multiplied by 85 of 195500.

If your taxes are delinquent you will not be able to pay online. If the actual value of the home increases the homeowner. Start Your Homeowner Search Today.

Real Property is Assessed each year by the Director of Equalization verified by the Auditor who then applies the mill levy and billed by the Treasurer who is responsible for collecting the taxes. Search Valuable Data On A Property. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would be 85.

Lincoln County has entered an agreement with GovTech Service Inc for online property tax payments. Please notate ID wishing to pay. SDCL 10-24 In South Dakota property owners have a period of time during which they can repurchase redeem their property by paying the amount owed including taxes interest penalties and additional costs incurred.

By the assessed market value of your property. For an additional convenience fee listed below you may pay by ACH or credit card. The Treasurer is not only responsible for collecting property taxes for the county but the city and school districts as well.

Please call the Treasurers Office at 605 367-4211. Redemption from Tax Sales. The money from the taxation of these vehicles is collected and remitted to the state of South Dakota.

Minnehaha County-2062 and Pennington County-1995. 53 rows Of that 14 billion or 203 of the total revenue collected comes from property taxes. Payments can be mailed to Pennington County Treasurer PO Box 6160 Rapid City SD 57709.

Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property. To protect your privacy this site uses a security certificate for secure and confidential communications. To update your address complete the Request to Change Tax Statemen t Mailing Address and email the completed form to recordscodakotamnus.

This is done using mass appraisal techniques. Such As Deeds Liens Property Tax More. This eastern South Dakota county has the highest property taxes in the state.

Property Tax Assessment Process. The Pennington County Equalization Department maintains an onlinesystem wherethe public can review property assessments and property information. Real Estate Taxes in South Dakota are due twice a year the first half on April 30th and the second half on October 31st.

If you would like to pay your Property Tax by credit card we accept Discover Visa and Mastercard. It contains Rapid City the second-largest city in South Dakota.

Property Tax Comparison By State For Cross State Businesses

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

States With Highest And Lowest Sales Tax Rates

Here S Who Pays The Most And Least In Property Taxes Property Tax Tax Property

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Property Tax Comparison By State How Does Your State Compare

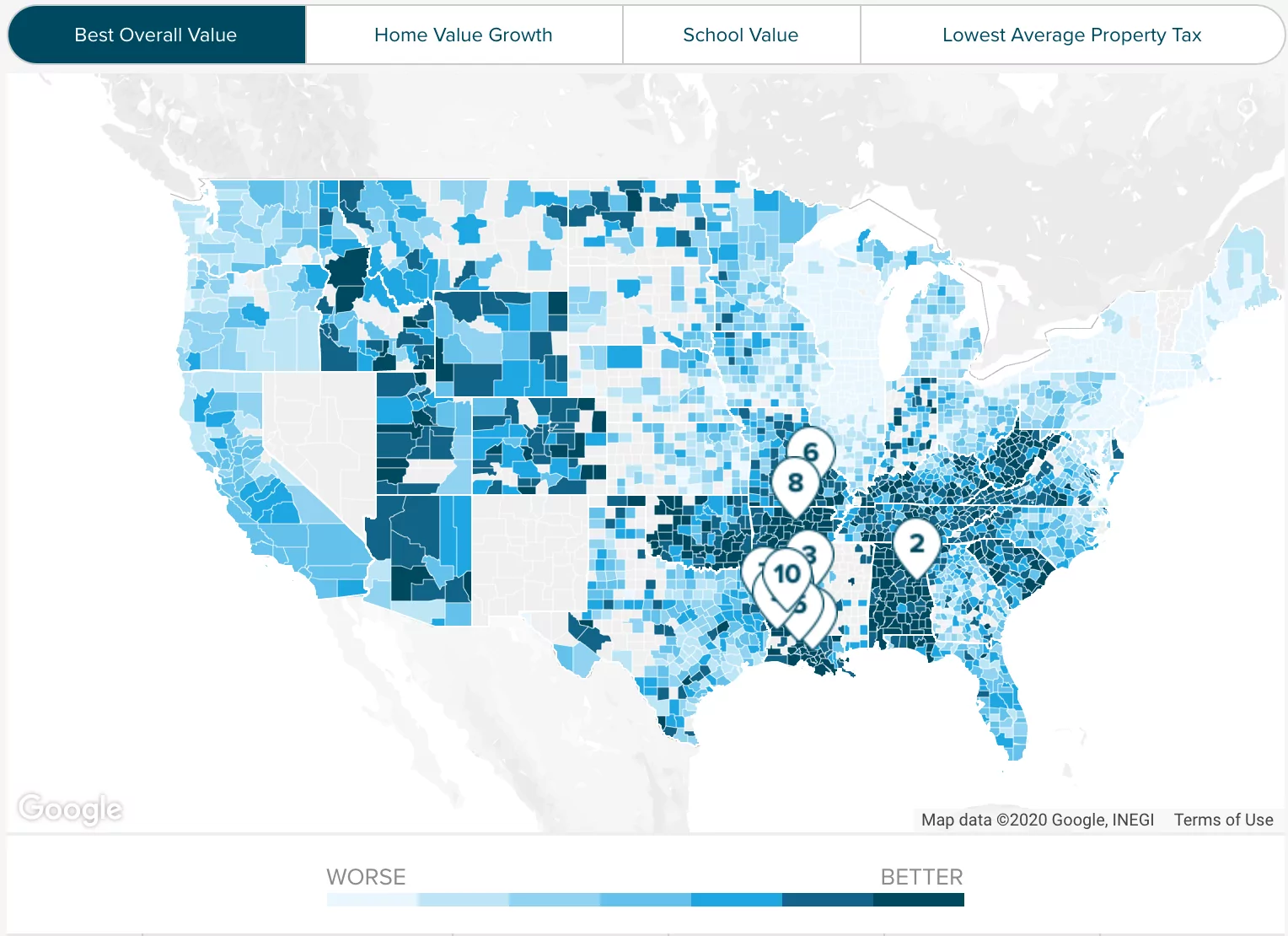

Property Taxes By State County Lowest Property Taxes In The Us Mapped

States With The Highest And Lowest Property Taxes Property Tax States High Low

Thinking About Moving These States Have The Lowest Property Taxes

Property Taxes How Much Are They In Different States Across The Us

Best States To Retired In With The Lowest Cost Of Living Gas Tax Federal Income Tax Income Tax

Property Tax By State Ranking The Lowest To Highest

4 Questions To Ask Before Buying A Home Ryan Serhant Property Tax Buying A New Home Home Buying

Property Taxes By State In 2022 A Complete Rundown

Property Taxes By State In 2022 A Complete Rundown

Here S How Much Tax You Ll Pay On A 2 Million Home In Each U S State Real Estate Places To Visit Real Estate Marketing

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)